Lets say you took home a gross monthly paycheck of RM3000 from your company in 2015 and if there were no tax. Company Tax Rate 2018 Malaysia Table.

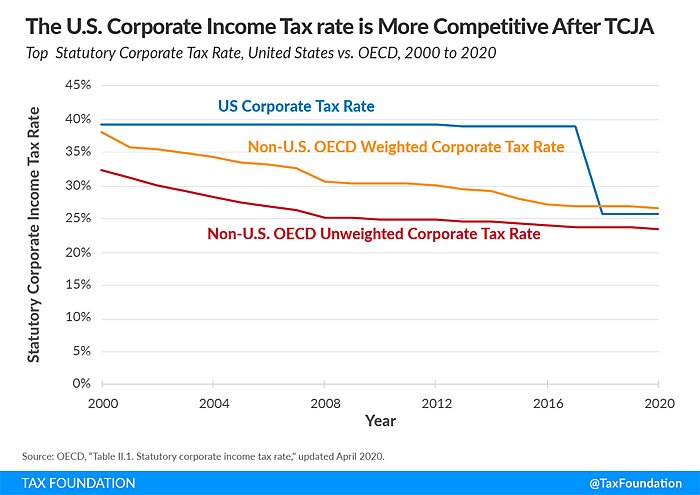

Global Corporation Tax Levels In Perspective Infographic Global Corporation Infographic Corporate

Tax Rate of Company.

. Company with paid up capital not more than RM25 million. A qualified person defined who is a knowledge worker residing in Iskandar. Tax Rate of Company.

Tax Rate of Company. Otherwise the general company income tax rate is 30. Corporate Tax Rates Corporate tax rates for 190 countries updated daily.

Dari luar Malaysia bagi syarikat insurans pengangkutan laut dan udara dan perbankan sahaja. Malaysias Companies Act 2016 entered into force and effect on 31 January 2017. Corporate - Taxes on corporate income.

Masuzi December 15 2018 Uncategorized Leave a comment 1 Views. Audit tax accountancy in johor bahru comparing tax. Income tax rates.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. Company Taxpayer Responsibilities. 2016 Special tax rates apply for companies resident in Malaysia.

Companies are taxed at the 24 with effect from Year of. Last reviewed - 13 June 2022. Resident SMEs with a paid-up capital in respect of ordinary shares of RM25 million and below at the beginning of the basis period for a year of assessment are taxed at a.

Effective from year of assessment 2015 individual income tax rates will be reduced by 1 to 3. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than. Based on the tax rate.

Malaysia Personal Income Tax Rates Two key things to remember. All income of persons other than. Malaysian ringgit.

The corporate tax rate in Malaysia is collected from companies. Malaysia Personal Income Tax Rates 2013. Tax Rate Of Company.

Corporate tax rates for companies resident in Malaysia. For both resident and non-resident companies corporate income tax CIT is imposed on income. Corporate income tax in Malaysia is applicable to both resident and non-resident companies.

The Act passed by. Update Company Information. Maximum tax bracket will be increased from exceeding RM100000 to.

From 2016-17 to 2019-20 the small business company tax rate was 275 having been progressively lowered from. Below are the rates. 25 percent 24 percent from Year of Assessment YA 2016.

Is Corporation Tax Good Or Bad For Growth World Economic Forum

New York State Enacts Tax Increases In Budget Grant Thornton

Income Tax Formula Excel University

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Eritrea Sales Tax Rate Vat 2022 Data 2023 Forecast 2014 2021 Historical

Yemen Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

The Malaysia Budget 2015 Will Be Announced By Datuk Seri Najib Razak On October 10 2014 At The Parliament This Infographics Sho Budgeting Infographic Malaysia

Taxing Corporations Might Be Good Politics But It S Still Bad Policy Cato Institute

Update On Anti Dumping For Some Monosodium Glutamate Msg Food Additives Asian Cuisine Chinese Restaurant

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Rates For Regular Gym Memberships At Miracles Fitness At The Garage Ocean View Gym Membership Fitness Membership Garage Gym

Individual Income Tax In Malaysia For Expatriates

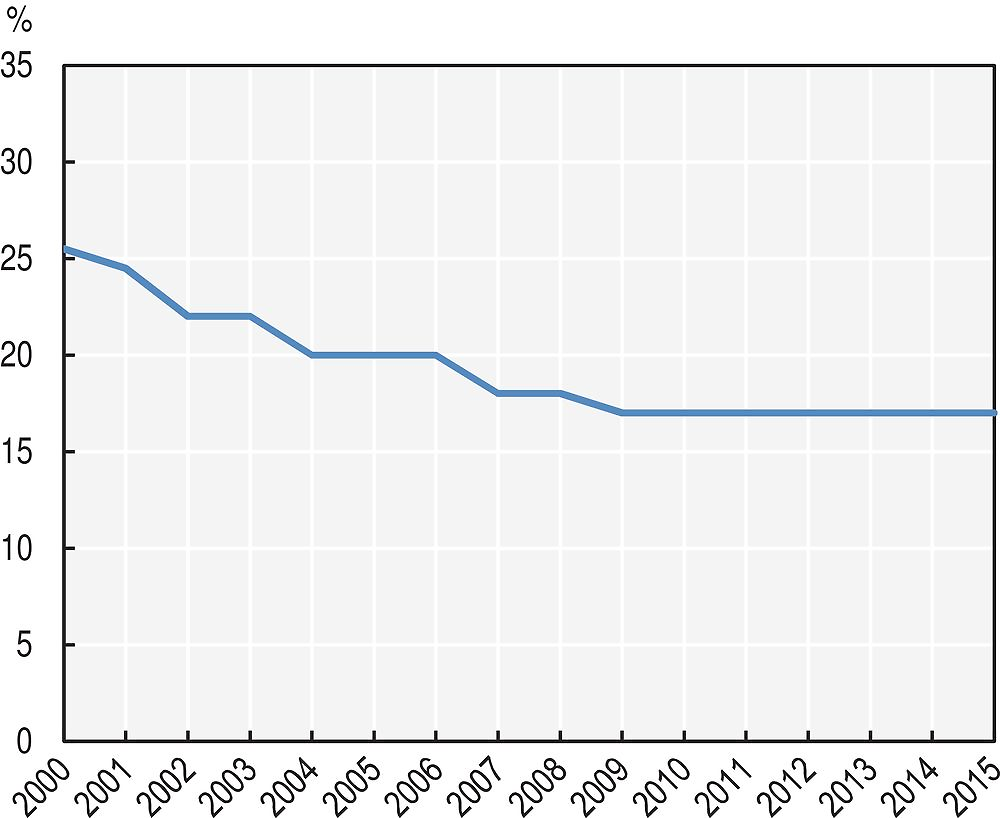

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd